Avanti Finance has transformed its funding profile in recent years. Caroline Dunlop, Head of Funding, recently sat down with KangaNews, discussing how the company is expanding its investor base, adding private credit capability and targeting NZ$5 billion in assets under management by 2029. The following article was originally published in KangaNews 2025 NonBank Year Book.

Q: How would you sum up Avanti Finance’s funding strategy?

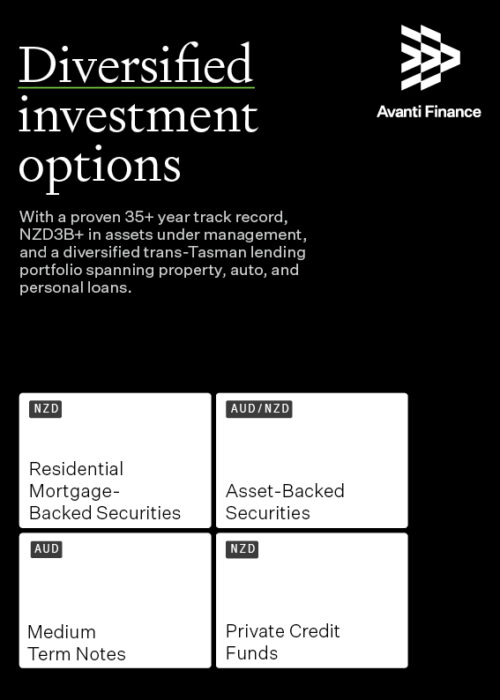

A: We are active in New Zealand and Australian capital markets. In New Zealand, we have been issuing RMBS [residential mortgage-backed securities] since 2018. Most recently, we returned to market in July 2025 with our first RMBS since 2022.

The gap was not about market conditions but about origination: New Zealand housing activity slowed significantly, resulting in fewer mortgages and fewer opportunities for nonbanks like us. It was therefore very pleasing to return to market this year, and the deal was well supported by investors. In fact, we achieved our best ever New Zealand RMBS pricing.

To put this in context, in 2015 Avanti Finance had no market issuance and more than 75 per cent of our funding came from a single bank lender. By June 2025, we had issued six New Zealand RMBS, one New Zealand auto ABS [asset-backed securities] and two Australian auto ABS transactions. We also have additional banking partners. This progression shows how far we have come in diversifying funding and broadening our investor base.

Q: How have market conditions and investor demand influenced your issuance plans?

A: We have seen positive changes. Our investor base has grown significantly over the past 2-3 years, which is very pleasing. Funding costs have come down as market conditions have been increasingly supportive, and demand for product has been strong in New Zealand and Australia.

This demonstrates there is healthy space for nonbank lenders like Avanti Finance in the capital markets. We value the relationships we have built with investors, and the increased engagement has reinforced our strategy to issue regularly and at competitive levels.

Q: How important is diversification to Avanti Finance’s funding plans?

A: Diversification is crucial. We are focused on building strong, long-term relationships with a wide range of funders. We already have this in place on the warehouse side. In our term deals, we have established a pool of consistent, repeat investors who know Avanti Finance and our products well.

These are predominantly domestic investors – New Zealand for our New Zealand deals and Australia for our Australian deals – but we have also attracted some offshore participation and will continue to broaden this reach.

It takes time to build trusted relationships with new investors, and we respect this process. What we know works is building confidence through repeat transactions, and our goal is to continue expanding this pool of meaningful investor relationships as we grow.

Q: What structural or product innovations are you introducing to broaden funding channels?

A: In FY25, we added private credit capability by establishing an Avanti Finance private credit fund in New Zealand. This complements our existing funding channels of bank warehouse facilities, term securitisation and MTN [medium-term note] issuance. The private credit fund provides an additional avenue for diversifying our investor base and funding mix.

About 30 per cent of our business is in Australia and 70 per cent in New Zealand; we expect this split to continue. We surpassed NZ$3 billion (US$1.8 billion) in assets under management in July 2025 and are targeting NZ$5 billion by 2029. Growth will come from both markets and across products.

Over the past few years, our auto-finance book has grown while the mortgage book contracted due to subdued housing activity in New Zealand. With mortgage lending now recovering, we anticipate more balanced growth across mortgages and auto finance going forward. Our personal loan book is also growing strongly and we expect to have a personal-loan ABS in time to complement our auto ABS offering. Alongside this growth, we aim to increase the proportion of assets funded off balance sheet as we work toward our 2029 targets.

To explore Avanti Finance’s diversified investment portfolio, visit www.avantifinance.co.nz/investors